In his writings, Morgan Housel introduces a mental model that is as applicable to corporate strategy as it is to personal finance: the concept of a "wide funnel and a tight filter." At its core, the idea is simple yet counter-intuitive. To find the few things that truly add value to your life—whether books, hobbies, or investments—you must be willing to expose yourself to a massive quantity of inputs (the wide funnel) but possess the ruthless discipline to abandon the vast majority of them (the tight filter).

Housel argues that we often fail because we are too selective at the top of the funnel (we don't try enough new things) or too loose at the bottom (we stick with bad decisions due to sunk costs). We fear the "waste" of starting a book and not finishing it, or buying a hobby kit and never using it. But Housel flips the script: this waste isn't a bug; it's a feature. It is the cost of admission for finding the outliers that change your life.

When we project this mental model onto the canvas of global capitalism, we see it perfectly embodied in a specific breed of company. Investor Mohnish Pabrai calls them "Spawners." These are organizations like Amazon, Alphabet (Google), and Meta, which do not rest on the laurels of a single successful product. Instead, they relentlessly incubate new, often unrelated businesses. They throw capital at the wall with a velocity that terrifies traditional accountants (the wide funnel) and, crucially, they kill the failures with a speed that baffles traditional managers (the tight filter).

This article explores the synthesis of Morgan Housel’s philosophy and Mohnish Pabrai’s investment framework, examining how the "wide funnel, tight filter" mechanism creates the most resilient, antifragile businesses in history.

Part I: The Philosophy of the Wide Funnel

To understand why a wide funnel is necessary, we must first accept a harsh reality of the world: outliers drive everything.

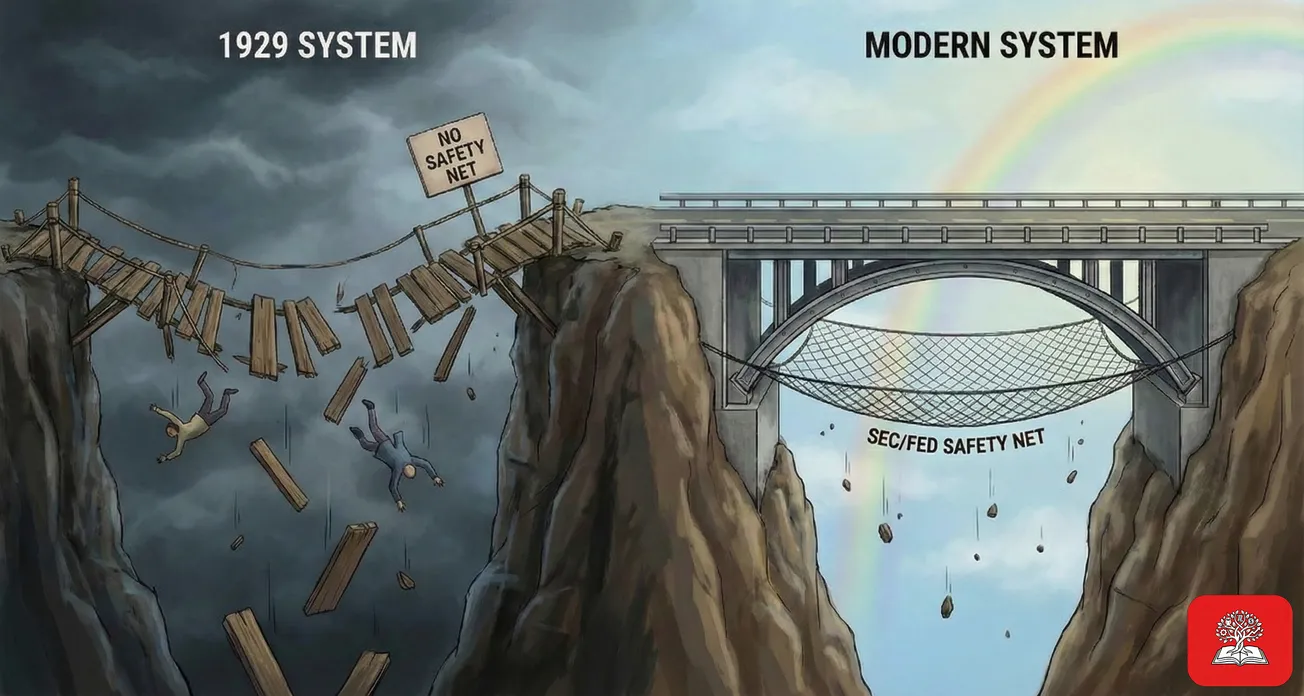

In finance, venture capital returns are not distributed normally; they follow a power law. A single investment in Uber or Airbnb pays for a thousand failures. Morgan Housel often points out that if you remove the top few performing stocks from the S&P 500 over the last century, the index’s returns drop to something resembling a savings account. The "average" doesn't matter; the "tails" dictate the outcome.

The Necessity of Variance

For a business to capture these tails, it must increase its variance. A company that only optimizes its core product—making the widget 1% cheaper or 2% faster—is narrowing its funnel. It is becoming efficient, but it is also becoming fragile. If the market for widgets disappears, the company dies.

The "wide funnel" mindset requires a tolerance for inefficiency. It demands that a company allocates resources to projects that look, on the surface, like distractions. It is the willingness to say, "We are an online bookstore, but let's try to build a cloud computing platform," or "We are a search engine, but let's try to build self-driving cars."

The "Day 1" Mentality

Amazon’s Jeff Bezos famously codified this with his "Day 1" philosophy. To remain in Day 1 is to remain in a state of constant experimentation. Day 2 is stasis. Day 2 is irrelevance. Day 2 is painful, excruciating decline. To stay in Day 1 requires a funnel so wide that it looks like chaos to the untrained eye. It involves exploring adjacent markets, non-adjacent markets, and embryonic technologies that may not yield a profit for a decade, if ever.

Part II: The Discipline of the Tight Filter

If the wide funnel is about permission—giving yourself the right to try and fail—the tight filter is about ego. Specifically, the removal of it.

The reason most companies fail to innovate is not a lack of ideas (the funnel is usually wide enough), but a lack of filters. When a traditional corporation launches a new initiative, it often attaches the reputation of a senior executive to that project. If the project fails, the executive’s career is damaged. Therefore, bad projects are kept on life support, draining resources and attention, because no one wants to admit defeat. The filter is clogged by ego.

Ruthlessness as a Virtue

Housel’s concept of the "tight filter" implies a lack of sentimentality. If you read 50 pages of a book and it doesn't grab you, you close it. You don't "owe" the author your time. Similarly, a Spawner company doesn't "owe" a failing project more capital.

Consider the Amazon Fire Phone. It was a disaster. It was late to market, gimmicky, and expensive. A "Day 2" company might have doubled down, spent billions on marketing to save face, and dragged the company down with it. Amazon, applying the tight filter, killed it. They took the write-down, licked their wounds, and moved the engineers to the Alexa and Echo teams. The failure of the phone became the fertilizer for the smart speaker.

This is the essence of the tight filter: Fail fast, fail cheap (relative to your size), and recycle the talent.

Part III: Mohnish Pabrai’s Spawners

In 2020, investor Mohnish Pabrai introduced the "Spawner Framework" to explain why value investing (buying dollar bills for 50 cents) was under-performing growth investing. He realized that static businesses—even cheap ones—eventually revert to the mean. But companies that "spawn" new businesses can compound indefinitely.

Pabrai categorizes Spawners into several types, which map directly to how they utilize the "wide funnel":

- Adjacent Spawners: Companies that move into related fields. Example: Starbucks launching frappuccinos in grocery stores.

- Embryonic Spawners: Companies that acquire small startups and blow them up into giants. Example: Facebook buying Instagram.

- Non-Adjacent Spawners: The rarest breed. Companies that create businesses completely unrelated to their core. Example: BYD moving from batteries to cars to masks. This requires the widest funnel and the most risk tolerance.

- Cloner Spawners: Do not innovate. They copy successful products. Examples: Microsoft with Azure (cloning AWS), Bing (cloning Google), Internet Explorer (cloning Netscape), etc.

- Apex Spawners: Companies that do all of the above. Examples: Amazon, Alphabet, Tencent.

The DNA of Mutation

Pabrai argues that spawning must be in a company’s DNA. You cannot simply hire a consultant to "install" innovation. It requires a founder or a culture that views the company not as a provider of a specific service (e.g., "we sell books") but as a machine for capital allocation (e.g. "we deploy cash where it yields the highest return").

This DNA is the corporate equivalent of Housel’s "wealthy" vs. "rich" distinction. A "rich" company has high earnings from one product. A "wealthy" company has the independence and optionality to survive if that product dies, because they have spawned five others to take its place.

Part IV: Case Study - Amazon

Amazon is the definitive case study of "Wide Funnel, Tight Filter."

The Wide Funnel: AWS

In the early 2000s, Amazon was an e-commerce retailer struggling with margins. The idea of selling their internal infrastructure as a service to developers seemed ludicrous. It was a classic "wide funnel" move—a non-obvious, high-variance bet.

Amazon invested heavily in Amazon Web Services (AWS) long before it was clear there was a market for it. They treated it as a startup within a giant. Today, AWS generates the vast majority of Amazon’s operating profit. It was a "wasteful" experiment that became the engine of the entire company.

The Tight Filter: Creating a Culture of Truth

How does Amazon apply the filter? Through its unique mechanism of the "Six-Page Memo" and the "Press Release." Before a product is built, a manager must write a press release describing the finished product and a FAQ explaining why it matters.

This process acts as a rigorous intellectual filter before capital is even deployed. If the press release isn't exciting, the project is killed on paper (the cheapest place to fail). If the project launches and fails to gain traction (like Amazon Auctions or zShops), it is ruthlessly shuttered. Amazon does not let zombie projects wander its halls.

By widening the funnel of ideas (anyone can write a memo) but tightening the filter of execution (the memo must be brilliant to get funding), Amazon ensures that it maximizes its chances of finding the next AWS while minimizing the cost of the next Fire Phone.

Part V: Case Study - Alphabet

Alphabet (Google) presents a more complex application of the theory. Their "wide funnel" is perhaps the most funded in human history, famously institutionalized as "Other Bets."

The 20% Time and X Development

Google’s famous "20% time"—where engineers could spend a day a week on side projects—is a literal implementation of a wide funnel. It crowd-sources innovation from the bottom up. Gmail and Google News were born from this wide funnel.

Furthermore, Alphabet created "X" (formerly Google X), the "moonshot factory." X is designed to tackle huge problems with radical solutions (Project Loon, Waymo, etc.). The entire purpose of X is to widen the funnel to the absurd.

The Filter: The Google Graveyard

However, critics often argue Google’s filter is too loose, or perhaps the wrong kind of tight. The "Google Graveyard" is legendary—a website literally exists to track the hundreds of products Google has killed (Plus, Stadia, Glass).

While users mourn these deaths, Housel and Pabrai would argue this graveyard is a sign of health. It proves the filter is working. A company that never kills a product is a company that isn't taking enough risks. The failure of Google Glass (consumer edition) was a necessary step in the data gathering for future AR endeavors. The shutdown of Stadia (cloud gaming) was a painful application of the tight filter—admitting that despite the technical brilliance (the wide funnel input), the business model (the filter criteria) didn't work.

However, the contrast with Amazon is stark. Amazon’s filter tends to happen before scale or after a decisive market rejection. Google has been accused of letting projects drift in the funnel too long before applying the filter.

Part VI: The Investor's Dilemma

For the investor, the "Wide Funnel, Tight Filter" model presents a valuation nightmare.

Traditional valuation models (DCF) rely on predicting future cash flows. But how do you model the cash flow of a "wide funnel" project that doesn't exist yet? How do you value Amazon in 2005 before AWS was disclosed? How do you value Alphabet's Waymo before robotaxis are legal?

When you find a Spawner, you must throw away the spreadsheet to some degree. You are not buying a stream of cash flows; you are buying a probability engine. You are buying a management team that has proven they know how to operate the funnel and the filter.

If you try to value a Spawner based solely on its current earnings, you will always find it "expensive." But if you view it through Housel’s lens, you realize you are paying for the optionality. You are paying for the 1,000 failed experiments that are necessary to uncover the one 100x return.

Red Flags

The danger comes when a company thinks it is a Spawner but is actually just an "Empire Builder." The difference lies in the filter:

- Spawners kill bad businesses.

- Empire Builders keep bad businesses to hide mistakes.

If you see a company acquiring random businesses (wide funnel) but never divesting or shutting them down (no filter), run. That is not a Spawner; that is a bloatware conglomerate in the making.

Conclusion: The Antifragile Synthesis

Morgan Housel’s "wide funnel, tight filter" is a recipe for a good life: read widely but quit bad books; meet many people but curate your inner circle; try many hobbies but master only the ones you love.

Mohnish Pabrai’s "Spawners" are the industrial application of this wisdom. They understand that in a rapidly changing world, the only sustainable competitive advantage is the ability to reinvent oneself.

By maintaining a wide funnel, companies like Amazon and Alphabet ensure they never run out of options. By maintaining a tight filter, they ensure they never run out of cash. For the investor, the leader, and the individual, the lesson is clear: Be promiscuous with your curiosity, but monogamous with your conviction. Explore everything. Keep almost nothing. But make sure that what you keep is worth the journey.

References

- Book: "The Art of Spending Money" by Morgan Housel (link)

- YouTube video: "Mohnish Pabrai’s Lecture, Q&A with students of Peking Univ. (Guanghua School of Mgmt.)–Dec. 3, 2020" by Mohnish Pabrai (link)

I highly recommend all material from Morgan Housel and Mohnish Pabrai, as they are great thinkers and gifted storytellers.